Basic Information

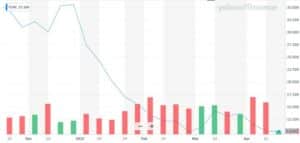

Fluence Energy Inc takes part in energy capacity items and administrations, and AI empowered computerized applications for renewables and capacity. It trades under the ticker symbol of “FLNC” on the New York Stock Exchange (NYSE). The company operates in the industry of renewable utilities. Fluence has a market capitalization of $1.83 billion and a float of 1 million. As of now, the stock of FLNC is trading at $10.09 per unit.

Business Description

Fluence Energy is a market-driving item, administration, and advanced applications supplier that is empowering the worldwide clean energy change. FLNC accepts that battery energy capacity innovation is at the focal point of change and is turning out to be considerably more significant as more renewables are added to the network and the transportation area moves towards zap. They are driving change by conveying configurable energy capacity items, administrations, and advanced application bundles, as well as AI-empowered inexhaustible offering enhancement programming. Their contributions assist with majoring utilities, engineers, and business and modern clients all over the planet convey a more feasible, dependable, and strong electric network in a repeatable, adaptable way.

Fluence is the main supplier of energy stockpiling innovation internationally, and their AI-empowered computerized applications assist clients with boosting the worth and execution of single frameworks or a whole arrangement of clean energy resources. The organization was laid out in January 2018 as a joint endeavor between Siemens and AES, individuals from their directorate and authority group were important for the establishing group at AES Energy Storage considered and tried the world’s first lithium-particle energy capacity framework on an electric network beginning in 2007. Fluence has based on AES’ industry-characterizing work in clean energy and capacity tasks and Siemens’ energy innovation authority and worldwide deals presence. The outcome is a dexterous organization with a worldwide presence exclusively centered around empowering energy change.

Fluence is perhaps the biggest supplier of energy capacity frameworks around the world, with 0.9 GW of energy stockpiling resources conveyed and 1.8 GW contracted, and a history of 13 years of involvement from their ancestor organizations. FLNC utilizes the diverse plan of edge applications, including Fluence OS and Fluence IQ, to change equipment into computerized resources that give the broad market and framework benefits and can completely coordinate with cloud-based advanced items like the Fluence Trading Stage. They have fostered a worldwide production network by developing a locally centered functional model with the goal of gathering items in the vicinity of significant business sectors and joining forces with inventive providers. Their energy stockpiling items are intended to work with many kinds of batteries, and they have laid out organizations with the main battery producers all over the planet.

Industry Overview

Energy capacity is a critical answer to the difficulties confronting power markets and transmission matrices, counting: power load changeability and quality issues from expanded cooperation of sustainable power age; developing consumer and modern interest for brilliant matrix benefits; and limited limit imperatives on transmission organizations, especially around times of pinnacle interest. Energy capacity is an interestingly adaptable, resource that can give different basic matrix administrations, including energy moving, cresting limit, subordinate administrations, and transmission and dissemination foundation capacities.

The industry has been developing energetically, expanding its power, and creating limits at a generally 8% yearly rate throughout the last ten years. Given expanding environmental change concerns, the speed has revived as of late. It requires to speed up further to assist with decarbonizing the economy. Environmental change is compelling organizations and different foundations to zero in on how they can do their part to decarbonize. Many organizations are consenting to drive buy contracts with electric utilities and other power generators to explicitly purchase power delivered from sustainable sources. In the interim, others are putting straightforwardly into sustainable power improvement projects. While many are doing this to turn out to be more socially mindful worldwide residents, environmentally friendly power is progressively prudent because of falling expenses for sunlight-based chargers, wind turbines, and batteries for energy capacity.

State-run administrations are additionally attempting to speed up worldwide decarbonization by proposing and passing regulations that would increment interest in the area. In August 2021, the U.S. Senate passed a $1.2 trillion foundation bundle that incorporates subsidizing to speed up clean energy ventures. Many perspectives on the need might have arisen to decarbonize the economy, recommending that future regulation could additionally support the country’s venture level.

Investment Summary

Fluence Energy Inc gone into a contract to obtain Nispera AG (Nispera). Nispera is a supplier of AI and AI-empowered software-as-a-service (SaaS) focusing on the environmentally friendly power area. Nispera’s cutting-edge innovation assists clients with checking, breaking down, figuring, and enhancing the exhibition and worth of sustainable power resources. Its leader offering is an AI-driven utility-scale resource execution at the board stage that at present has 8 GW of resources under administration across 450 breeze and sun-oriented projects on a worldwide premise. In mix with Fluence IQ’s advanced application contributions, Nispera’s set-up of five applications will empower the consolidated firm to offer its clients a client-driven “oversee application”.

Chief Julian Nebreda purchased 8,000 portions of Fluence Energy stock in an exchange dated 15th February. The stock was gained at a typical expense of $13 per share, with a complete worth of $104,000. Likewise, CEO Manuel Perez Dubuc purchased 10,000 portions of Fluence Energy stock. The offers were purchased at a cost of $12.90 per share, with an absolute worth of $129,000. In recent days, insiders have purchased 29,438 portions of organization stock esteemed at $384,736. 0.01% of the stock is right now possessed by organization insiders.

Morgan Stanley diminished their cost objective on Fluence Energy from $34 to $16 and set an “equal weight” rating on the stock in a report on 5th April. Zacks Investment Research overhauled Fluence Energy from a “sell” rating to a “hold” rating in an exploration report on 29th March. JPMorgan Chase and Co. diminished their price focus on Fluence Energy from $45 to $39 in an exploration note. Citigroup diminished its price focus on Fluence Energy from $47 to $28 and set a “buy” rating for the organization in an examination note on 15th February.

The Zacks Investment Research forecasts the earnings (EPS) for Fluence Energy to be -$1.11 per share in FY2022, -$0.29 in FY2023, $0.64 in FY2024, and $1.44 in FY2025.

Valuation

The absolute valuation of Fluence is based on several metrics. The table below shows the few metrics used for the valuation of the firm.

|

|

2021 | Current |

| Price/Sales | 2.59 | 0.74 |

| Price/Book | – | 2.16 |

| Price/Forward Earning | -50 | – |

| Earning Yield % | -9.20 | -34.93 |

| Enterprise Value/Revenue | – | 0.82 |

| Enterprise Value/EBITDA | – |

-2.41 |

Financials

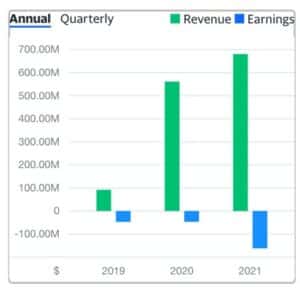

Fluence’s total revenue in the financial year 2020 was $561.3 million against $92.1 million in the financial year 2019. The company reported a profit of $7.9 million in FY2020 compared to a loss of $7.9 million in FY2019. Moreover, the total loss of the company in FY2020 was $46.7 million in the financial year 2021 versus $46.9 million in the previous year. As of 30 September 2020, the total assets of Fluence were $364 million and the total liabilities were $381 million. Moreover, the cash and cash equivalents of the company as of September 2020 were $93.8 million.

Investment Risks

Investing in FLNC normal stock implies a serious level of risk. One ought to painstakingly think about the dangers and vulnerabilities, along with all the other data in this outline, including the combined budget reports and the connected notes, prior to choosing to invest. The risk involved in the business are listed below

- Restricted working and income history as an autonomous substance and their incipient industry make assessing their business and future possibilities troublesome. Their future development is subject to the rising interest in clean electric power arrangements that can give electric power with lower fossil fuel by-products and substitution of traditional-age sources and the reception speed of advanced programming applications to modernize the proficiency of force resources and the electric network.

- The organization has encountered and may keep on encountering deferrals, disturbances, or quality control issues in its assembling activities to some extent because of the outsider producer focus.

- FLNC has encountered and may keep on encountering openness to changes related to development, utility interconnection, cost overwhelms, and delays, including those connected with getting government licenses and different possibilities that might emerge throughout finishing establishments.

- The interference of the progression of parts and materials from global merchants could disturb the supply chain, because of the burden of extra obligations, levies, and different charges on imports and products.

- Fluence Energy relies upon its senior supervisory crew and other key representatives, and the deficiency of at least one of these representatives or powerlessness to draw in and hold other profoundly skilled workers could hurt the business.

Environmental, Social, and Governance (ESG)

FLNC is a carefully designed, reason-driven organization with a mission to change the manner in which they power the world for a more supportable future. They support the perfect energy progress by empowering more prominent reception of environmentally friendly power and decarbonized innovations like electric vehicles and decreased utilization of warm age assets.

Fluence tries to go past the intrinsic natural parts of innovation and execute reasonable and moral cycles. Their provider governing set of rules is at the center of their consistent assumptions and addresses ecological security, minerals, and defilement, among different regions. The firm buys unrefined components and minerals from confided-in providers.